The new year can bring uncertainty to the mortgage market.

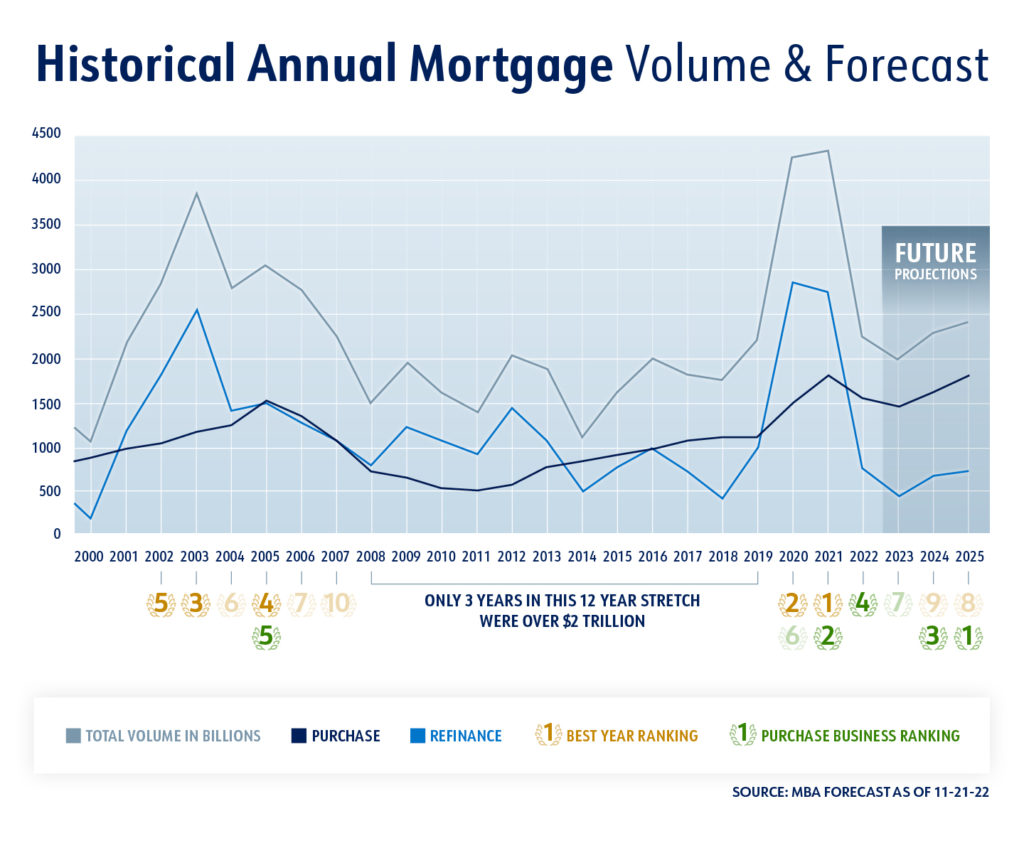

After record-breaking years in 2020 and 2021, the industry saw a significant drop in home purchases and refinances in 2022. This naturally leads to the question – “What can we expect for 2023?”? According to the MBA (Mortgage Banker Association), 2023 is forecasted to begin a strong growth cycle in the home purchase sector. As you can see in the chart below, 2024 is projected to be 3rd Best for Purchase Business, and 2025 is projected to be 1st! That’s incredible! This is primarily due to rates settling in. Rates for Conforming 30-year fixed products are projected to settle in the mid-5% range by the end of 2023 and then fall to the mid-4% range in the following year. Even though the housing market slowed in 2022 due to high rates, we should see positive shifts this year with home prices and mortgage rates slightly falling, allowing more customers to qualify for home financing.

Looking at the data with perspective, the purchase market over the next few years looks strong. Refinances will likely have minimal growth due to rates dropping, but home equity is still a fantastic tool to leverage when large expenses loom. If you are interested in leveraging your home equity or want to refinance to a lower rate, speak with a Highlands Loan Officer and see what options you may have!

The chart below helps demonstrate how the mortgage industry is expected to move in an upward trend – and gives context against historical data. If you want to purchase a home or refinance in 2023, Please reach out, and we’ll be happy to answer any questions you may have.